Top 10 Ex-Pat Mistakes: Chapter 11

Top 10 Expat Mistakes + What NOT to post on Social Media

We all make mistakes and most of them you can walk away from with the knowledge of what not to do next time. However, there are some Expat mistakes that you simply cannot just chalk up to experience.

The saying “She’ll be right Mate” may be endearing in Australia, but here in the US, ignorance is not an excuse.

There are simple mistakes that can severely impact your finances and or your liberty, and the hangover may last for years. In the context of an Australian Expat living in the US, this chapter highlights our Top 10 Expat Mistakes, and what NOT to post on social media.

Top 10 Expat Mistakes

#10: Trusting Australians who do not deserve your trust.

It is true that Australian expats tend to trust each other instinctively. On a scale of one to five, every Aussie seems to give each other a solid three on the “Trust-O-Meter”. However, not all Australians living in the US have your best interest at heart.

Beware of individuals and companies attempting to capture your email and contact information. There is no such thing as a free lunch in New York, so chances are your information is being sold – or worse!

The Australian Community is a US public charity. Advice to job seekers, networking tips and the differences in the US interview process are all freely available through this book.

However, our highly successful charitable programs for assisting Australians overcome the challenges of living in the US have in some instances been copied by unscrupulous individuals, repackaged, and are now being either sold to Australians for a fee, or personal information captured and sold.

Members who choose to join our organization pay an annual tax deductible fee of $45.00. This gives access to additional resources through our private Enterprise Social Network that contains more than two dozen groups covering Accounting to Visas. It also provides professional connections to more than 1,000 Australians living in the US.

Our network is powered by Microsoft Yammer which can quickly find an answer to any question that has been asked on a topic. Moreover if you cannot find an answer, you can tap into the knowledge of professional Australians living in the US, not just rely on an individual claiming to be an expert.

#9: Ending up on a Tenant “Black List”

If you can accept that there are always going to be issues when renting apartments, communal living in a city can be less stressful. Resolving any disputes amicably with your landlord is a good first step, but what happens if an action in Landlord Tenant Court is looming?

You may consider finding somewhere else to live. This may sound defeatist but even if you are 100% in the right, if an action is started in NYC Housing Court, your name will most likely be added to the tenant “Black List”.

Landlords and agents use public records to create a Black List to identify any potential trouble makers prior to approving a new apartment lease. See NY Times Article

If your name is on a Black List, regardless of your creditworthiness, that sunny new apartment you just applied for has Buckley’s chance of being approved.

#8: Not understanding whether you meet the Substantial Presence Test.

The Substantial Presence Test is a calculation that determines if you are a US resident for tax purposes. This does not give you any additional rights, just obligations under the IRS tax code to file and pay taxes applicable to US residents.

The magic number is 183 days.

It is calculated by adding all of days you were present in the US in the current year, 1/3 of the days of the year prior, and 1/6 of the days of the year before that. You must also be present a minimum of 31 days in the current year.

Naturally many companies ensure that their foreign executives do not exceed the 183 day test as this would kick off a series of tax consequences. Some of the obligations follow.

For specific information you can listen to our Tax Podcast.

#7: Failing to file a Foreign Bank and Financial Accounts (FBAR) or Foreign Account Tax Compliance Act (FATCA) Report

Everyone understands that paying income tax and filing a tax return are a given in the US if you are a US Tax resident, but there are additional filing requirements who have met the Substantial Presence Test: FBAR and FATCA.

Here is a link to the IRS website that shows the differences between FBAR and Form 8938

FBAR applies if you add up all of your non US bank and investment accounts (including those you are a signatory) and if on one or more days in the previous tax year these totaled more than US$10,000, you must file a FBAR. Depending on your assets you may also have to file FATCA.

You can follow the links to read more about each of these filing requirements, but bottom line is that if you fail to file, you may face a minimum $10,000 fine, or if it is deemed that you deliberately failed to file, the fine jumps to half of the value of your overseas cash and investments.

This may come as a shock to many who are hearing about this for the first time, or who were given misinformation and told that it did not apply to them.

This article is not meant to provide any specific tax or legal advice, but discussing your FBAR and FATCA obligations with your accountant is highly recommended, especially as to whether Australian Superannuation is considered exempt.

You can click here to listen to a top tax adviser discussing some of the tax challenges facing Australian expats.

#6: Failing to have an Estate Plan

Other than Taxes, the only other guarantee in life is death. Failing to have an Estate Plan effects Australians more than Americans given Death Duty was abolished in Australia in 1979, but it is may be as much as 40% or higher here in the US.

The most basic Estate Plan is a will. If you are going to be staying in the US for any length of time, creating a US will is going to remove any question as to the legality of an Australian Will under US law.

If you are an expat and you meet the Substantial Presence Test, the IRS will tax your global estate should the worst happen. Simply being an Australian citizen will not protect you from US Estate Tax.

If you have Australian trusts set up, you are also going to need a professional to review these trusts to ensure that they will stand up to US tax law, or risk them being “pierced” by the IRS and their contents taxed.

The good news is that there are some legal strategies that use insurance policies inside trusts to ensure that your beneficiaries are not left with a major tax burden.

If you are unfamiliar with US Estate Tax or you have concerns, it might be a good idea to speak with your Accountant or Financial Adviser to ensure that your Estate Plan is in order.

The Australian Community can connect you with Australian professionals who are experts in this field.

#5: Driving on your Australian License after 90 days in the US.

It varies from State to State, but there is a limit as to the number of days you can drive legally on your Australian license.

In New York State, after 90 days of maintaining an address, you have 30 days to obtain a New York driver’s license. NY DMV Reference

New York will generally exchange an out of State license if you have one, but other than that, you are going to have to sit for a driving test.

The typical rationalizations for not complying with this are: “If I can rent a car with my Aussie license that should be OK? Right?” and “How would the Police know?”

Get pulled over for speeding or be involved in a minor fender bender and you are going to be asked some basic questions from the Police. Lying to the Police can be a misdemeanor offence, so you are going to make a bad situation worse when asked “When did you arrive in the US?” – especially since Law Enforcement’s computer system is now tied into Homeland Security.

#4: Failing to carry your Green Card with you at all times

The Immigration and Nationality Act (I.N.A.) Section 264(e) states that if a Permanent Resident fails to produce their green card, it is a misdemeanor and if you are found guilty you can be fined up to $100 and put in jail for up to 30 days.

Like it or not, that is the Law.

It would be a very unusual circumstance for you to be arrested and charged for not having your Green Card, but if say you produced an Australian license after being pulled over for speeding, and you had just lied to Police about why you do not have a US driver’s license, you may have failing to produce your Green Card added to your charges.

It costs $450 to file a Form I-90 to replace a lost Green Card. Some people may consider this “the cost of doing business” if you lose your wallet rather than risk not carrying your Green Card.

Now that almost everyone has a smart phone, snapping a picture of both sides of your Green Card and saving it to the cloud is advised.

#3: Failing to notify US Customs and Immigration Service that you have changed address.

Given most Australians are working in the US on Green Cards or non-immigrant visas such as the E-3 or L-1 etc., you must notify USCIS within ten (10) days if you change address.

Sounds like no big deal, until you read the penalties for failing to file a Form AR-11:

“A willful failure to give written notice to the USCIS of a change of address within 10 days of moving to the new address is a misdemeanor crime. If convicted, you (or the parent or legal guardian of an alien under 14 years of age who is required to give notice) can be fined up to $200 or imprisoned up to 30 days, or both. The alien may also be subject to removal from the United States. (INA Section 266(b)). Compliance with the requirement to notify the USCIS of any address changes is also a condition of your stay in the United States. Failure to comply could also jeopardize your ability to obtain a future visa or other immigration benefit.”

#2: Taking legal, immigration and tax advice from posts on Social Media

You see them all of the time in social media groups: Posts giving bad advice on how to work two jobs on an E-3 or misinformation about your FBAR filing requirement. There are even blogs dedicated to how to circumvent Immigration law such as self-petitioning for an E-3 visa or commuting on a B1 visa.

The Australian Community has always maintained a policy of providing links to the IRS, USCIS or ethical legal and tax information.

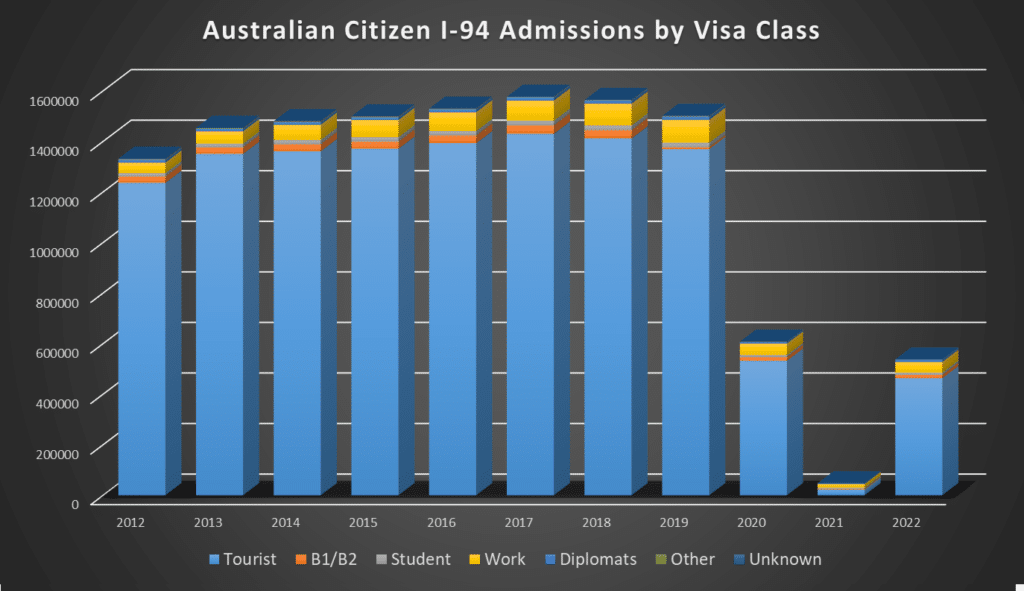

Our AI Volunteer Joey is raising the bar by providing our members direct access to Tax, Legal and Immigration professionals through instant messaging.

Certainly there are simple answers to simple questions, but taking advice from anyone other than a professional on complex issues usually results in either addition expense by having to undo the bad advice given in the first place, or in a worst case scenario loss of liberty through arrest and deportation.

#1: Being Arrested

Some Australians may see the law in 256 shades of grey, but here the law is in black and white.

Something as simple as jumping a subway turnstile may seem a victimless crime, but it can also have you arrested in a New York minute. Add resisting arrest or giving a false statement to Police and your day is going from bad to worse.

If you are arrested, US law gives you the right to remain silent. Once you request a lawyer, the police cannot question you further.

The Australian Government can provide limited services to its citizens who are arrested in the US, and this link explains some of these services.

Rule #1 in the US is OBEY THE LAW, follow that advice and you will avoid finding yourself in a worst case scenario.

What NOT to post on Social Media

It may seem incomprehensible, but it is still quite common for Australian expats, and “E-3 Hopeful” Aussies to publicly post on social media that they are breaking, or intend to break US law.

In light of a recent News.com.au article, we thought it important to also point out common social media posts that can cause serious legal and immigration issues, including a denial of a visa, or voiding your existing work visa.

Just in case you missed the memo… Here are some examples of social media posts that can have Australians “treated like criminals” as the article claims.

#7: Advertising Short Term Rentals

Scan any of the “Aussies in [INSERT US CITY]” Facebook Groups and you will see a plethora of posts for short term rentals, as well as posts requesting short term rentals (less than 30 days).

Just because it says it’s a private group, does not make it so!

In New York State, renting an apartment for less than 30 days is not only illegal, but it is illegal to simply advertise a rental of less than 30 days.

You can read Senate Bill S6340A “Prohibiting advertising for the use of dwelling units in a class A multiple dwelling”.

Whether or not New York City or State decides to crack down on the advertising of short term rentals (in social media), the fact is that advertising renting your apartment for a few weeks when you are visiting Australia is openly breaking New York State Law.

This may give rise to some awkward questions at a US border upon your return.

If you sublet your home for more than 14 days a year, you must declare it as Residential Income to the IRS. If you use Airbnb, they will automatically report to the IRS income from any customer who rents 14 nights or more. See this link.

Subletting a room to help pay the rent is generally not considered income, but renting out your Apartment for a profit could land you in serious hot water with the USCIS.

#6: Updating your Social Media too early after a Job Offer

Many can relate to the excitement of receiving a US job offer. There are several tasks ahead in the visa application process including completing your paperwork and booking an E-3 interview at a US Embassy.

One item you should NOT do is update your LinkedIn profile, or add your new workplace to your Facebook profile.

There are real world stories where Australians have rushed to add their new position to their social media BEFORE they have their E-3 visa approved.

Aussies have been detained and denied entry back into the US after a quick weekend in Mexico or Canada during the application process, based solely on the fact that their social media says they are working for a US company when not in possession of a valid work visa.

#5: Posting Questions on How to Self Petition for an E-3 Visa

It is a given that US corporations can sponsor Australian employees on an E-3 visa. For those more “entrepreneurial” Australians, there are websites and social media groups who offer advice on how to setup a US Corporation and self petition for an E-3 visa.

However if the intent of establishing a US corporation is solely for the purpose of self petitioning for an E-3 visa, the law is very clear, and this self petitioning may be deemed as “Improper entry by an Alien”.

If so, then that person would be in violation of 8 U.S. Code § 1325 (d) – Immigration Related Entrepreneurship Fraud:

“Any individual who knowingly establishes a commercial enterprise for the purpose of evading any provision of the immigration laws shall be imprisoned for not more than 5 years, fined in accordance with title 18, or both.

#4: “Actively Looking” for work whilst in the USA on an ESTA or B1/B2

If there was any grey area on this subject, that ship has long sailed. However you do not have to look far to see posts on social media stating that someone is actively looking for work on a tourist visa.

Regardless of whether you are on a B1/B2 or ESTA, “looking for work” cannot be the primary reason you are entering the US. If you are here for legitimate business or tourist reasons, and you are inadvertently offered work, that is very a different case.

However, posting that you are looking for work on public social media will almost certainly result in the denial of a visa (including an E-3), including a ban on further entry into the US.

#3: Travel to Cuba

There is no doubt that since the US opened a pathway for US citizens and residents to legally visit Cuba, there has been a surge in tourism enquiries. However, there are only very limited visa categories and strict guidelines for visiting what is still a Communist Nation under a US economic embargo.

You may be forgiven for asking on public social media if you can apply for an E-3 at the US Embassy in Havana, but if you are posting selfies of you drinking Mojitos at Club Havana, your travel had better fallen under one of 12 categories of authorized travel.

If not, that Mojito alone is going to cost you a $7,500 fine for starters…

#2: Posting questions on recommendations for Immigration Attorneys

Dual Intent or Immigrant Intent are concepts within US law that deal with all persons on non-immigrant visas, being assumed that they intend to illegally stay in the US: You are presumed guilty unless you can demonstrate your intent to return to your home country before your visa expires.

This enables Immigration and Border Protection Agents to do their jobs and ensure that every person entering the US is being truthful about their stay in the US, and detain and deport anyone they believe is not being truthful based on presumed “Immigrant Intent”.

Immigrant Intent includes looking for work or marrying a US Citizen.

One red flag for a CBP Agent, aside from a stack of Resumes (or a box of tools), is to be in possession of an Immigration Attorney’s business card. The assumption is that once you gain entry on a visa (or visa waiver), your intent is to contact that Attorney to change your immigration status. This is grounds for denial of entry into the US.

Similarly, if you are on a tourist visa, and you post that you are looking for recommendations for an Immigration Attorney, this could be interpreted as “Immigrant Intent” and next time you try and cross into the US, you could be stopped for questioning.

#1: Posting Green Card questions about marrying a US Citizen

According to Zjantelle Cammisa Markel, an Australian immigration lawyer based in NYC, “If you do anything that’s inconsistent with you visa application within 90 days, it can be considered a misrepresentation”.

Aside from applying for an E-3 visa whilst on an ESTA, getting married in the first 90 days of a tourist visa is going to raise some serious red flags.

If you posted a question on your social media, that you are looking for advice on, or concerning marrying a US Citizen for a Green Card, then:

a) Your Green Card application may well be denied on the grounds of “misrepresentation” when you entered the US.

b) If you posted it before leaving for the US, do not be surprised if you are detained by US Immigration at the border, asked some serious questions, and even sent home on the next flight.

Common Sense and the Age of the Internet.

It is very clear that there are distinct sets of people who find themselves in serious hot water with US immigration after social media posts:

a) Those who are knowingly breaking US Law, but do so anyway.

b) Those who feel entitled, and that US Law does not apply to them.

c) Those who are looking for free advice on public social media.

d) All of the above.

In the Age of the Internet some people have never developed an inner voice that tells you “I wouldn’t post that if I were you”. The fact is that some people think nothing of reaching out to strangers on public social media and asking legal questions on Immigration Law.

Whereas in the past, certain questions that were protected by Client / Attorney privilege are now openly out for everyone to read, including the US Government. As a result, more and more people are being caught in a web spun by a simple lack of common sense. #nofilter

In spite of what you may read on social media, there is no “right” to enter the US, even if you are in possession of a valid visa, E-3 or otherwise. The US has always had very strict Immigration Laws, and a zero tolerance for those who would break them.

The current Administration is simply hardening existing laws, and ensuring that they are enforced.

Our organization from day one has told its members (and anyone else who will listen) to always follow Rule #1: OBEY THE LAW; and if in any doubt about Rule #1 seek professional advice.

You may not agree with it all the time, but it is US Law all of the time – and remember – social media posts are forever!

Click here to read “Moving to the US for Aussies” from the beginning

Before you send money Overseas!

Use this Currency Converter to gauge how much money you could save over your existing FOREX service by accessing The Australian Community’s Preferred OFX Rate.

Currencies can fluctuate by the minute. This Converter is indicative of the Preferred OFX Rate at this time.

However, once you register and access our Preferred OFX Rate, you will see the current converted rate, and the converted amount before making your transfer.

About The Australian Community

Founded in 2011, we connect more Australians in America.

If you are a professional Australian taking your career to the next level, or the U.S. is the next step in your company’s global expansion, we can connect you to all of the resources you need for success in America.

Did you find this article helpful? Make a Donation!

The Australian Community is a 501(c)(3) organization, and all donations are fully tax-deductible under the IRS Code.

Join The Australian Community.

Learn more about the benefits of joining The Australian Community in America.