How many Australians live in America is a question that is often asked but challenging to answer. This report attempts to answer the perennial question based on data directly obtained from the U.S. Government.

It comes as no surprise that the Global Pandemic severely impacted the number of Australians obtaining visas in 2020 and 2021. 2023 was an important year as it placed some distance between the data impacted by the Pandemic. A separate report answers the number of Australian who repatriated in 2020.

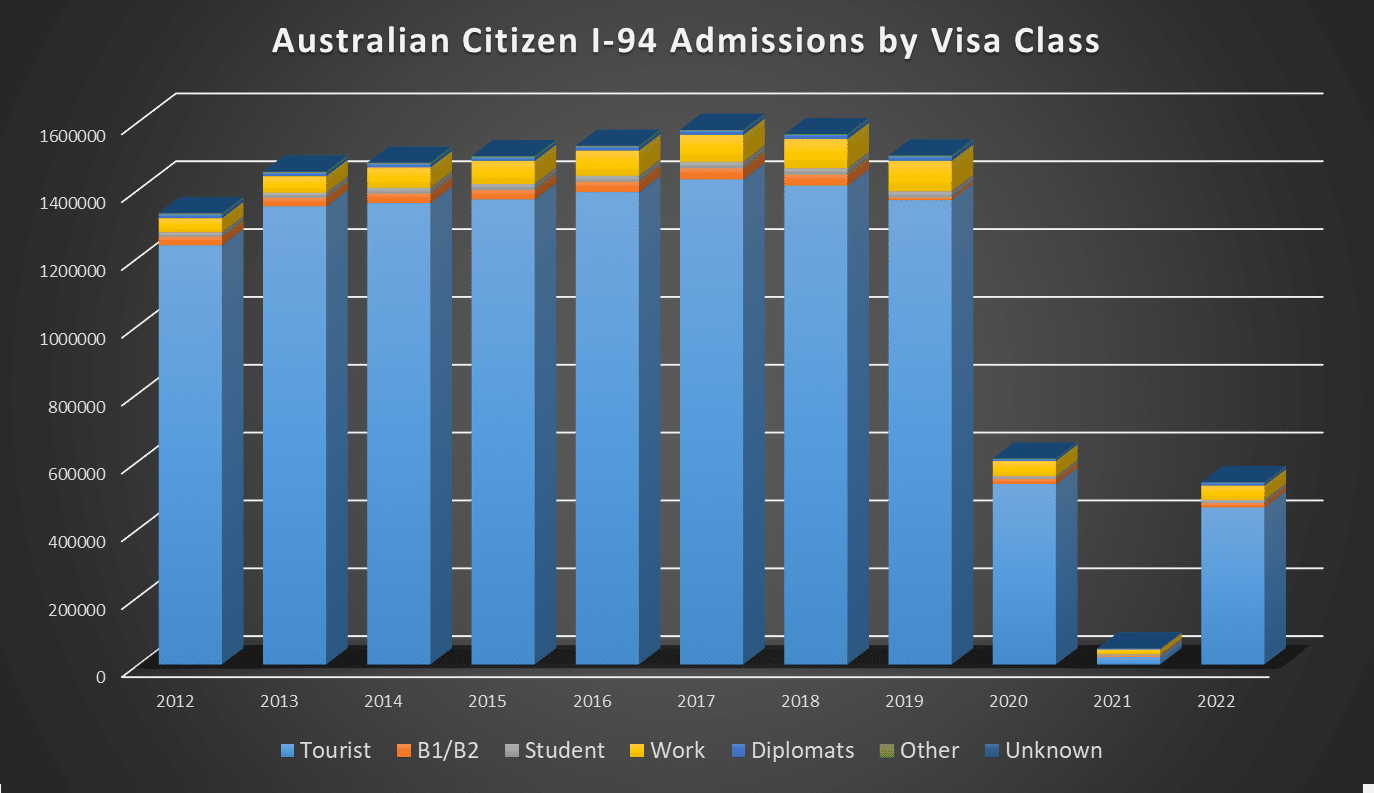

Part of this report relies on I-94 data – which is recorded every time an Australian enters the U.S. on a visa. While this number can skew high as an individual can make multiple entries, it is helpful for interpolating trends. I-94 data lags by 12 months.

Australian Citizens Entering the United States on an I-94

What is unequivocal is that we can see that the vast majority of Australians entering the US are on tourist visas. Except for 2021, there is a high probability that if you bump into an Australian, they are on a Tourist/Visa Waiver and do not live in the U.S.

Tourist crossings in 2020 were 532,815, and 23,096 in 2021.

Total crossings in 2019 were 1,524,305, and only 537,835 in 2022 so there is still a long way to go to return to the Mean.

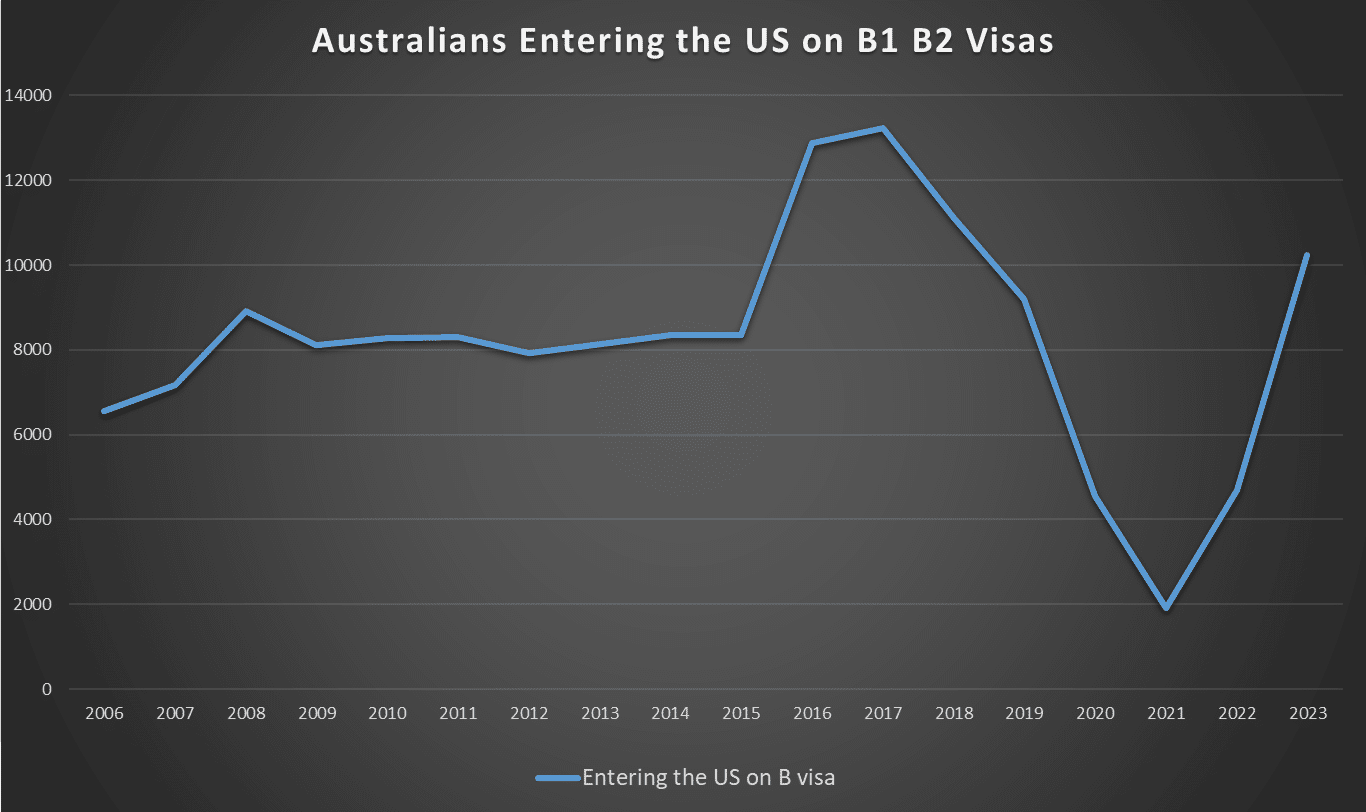

Entering the U.S. on B Visas

B Visa crossings also rebounded from 1,917 in 2021 to 4,697 in 2022 and again in 2023 to 10,247. This, however, is only at 2015 levels.

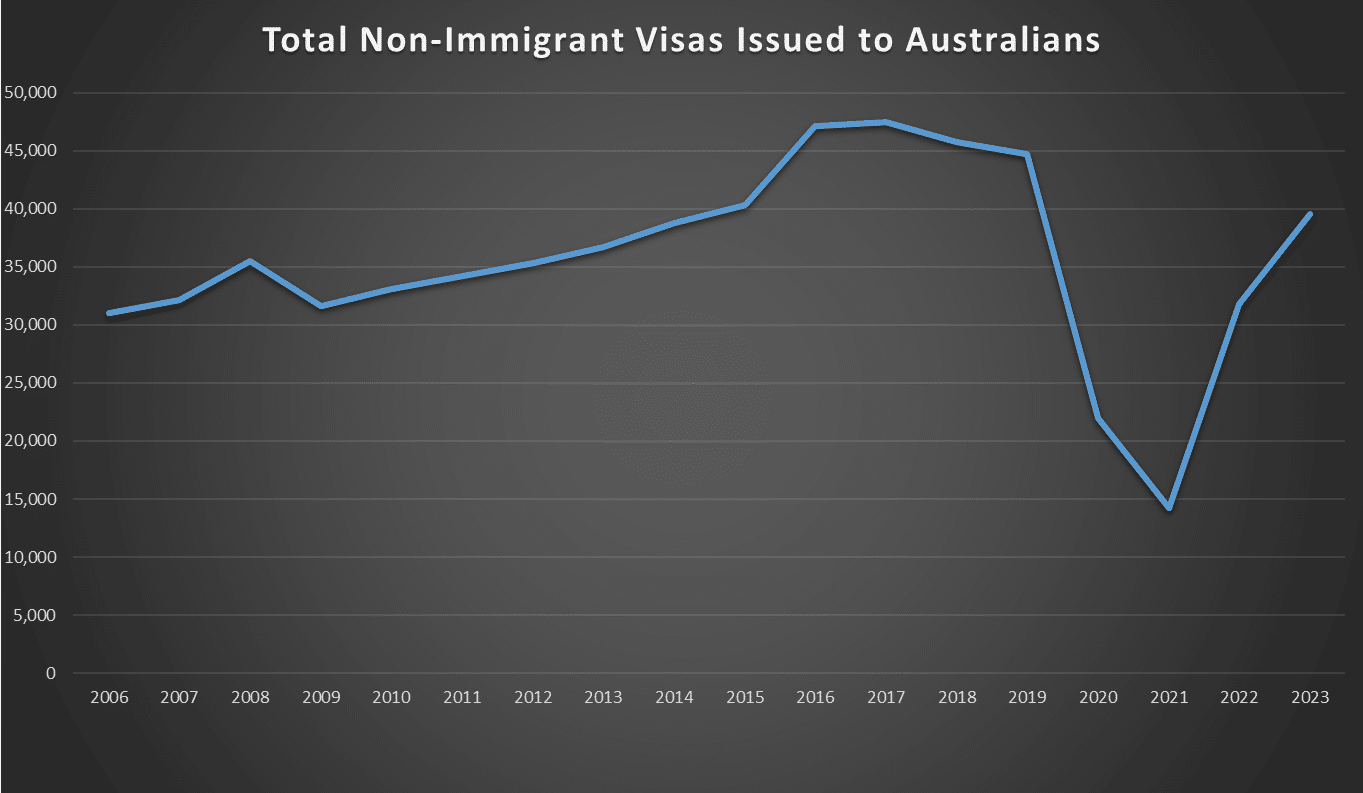

Non-immigrant visas issued to Australians living in America

To understand how many Australians live in the U.S., we first need to look at the number of non-immigrant visas that are issued. Given that non-immigrant visas expire every two years, adding the latest two years of data will give a rough estimate.

In 2020, the total number of Australians issued with Non-Immigrant visas declined by more than 50%, and then another 36% in 2021!

However, we witnessed a sharp increase of 124% in visas issued to Australians in 2022 over 2021 to 31,825 visas. In 2023 we saw a bump to 39,564. However, this again only brings us to the level of the number of visas issued in 2015.

Based on these numbers, it is estimated that approximately 70,000 Australians were on non-immigrant visas and living in America at the end of 2023.

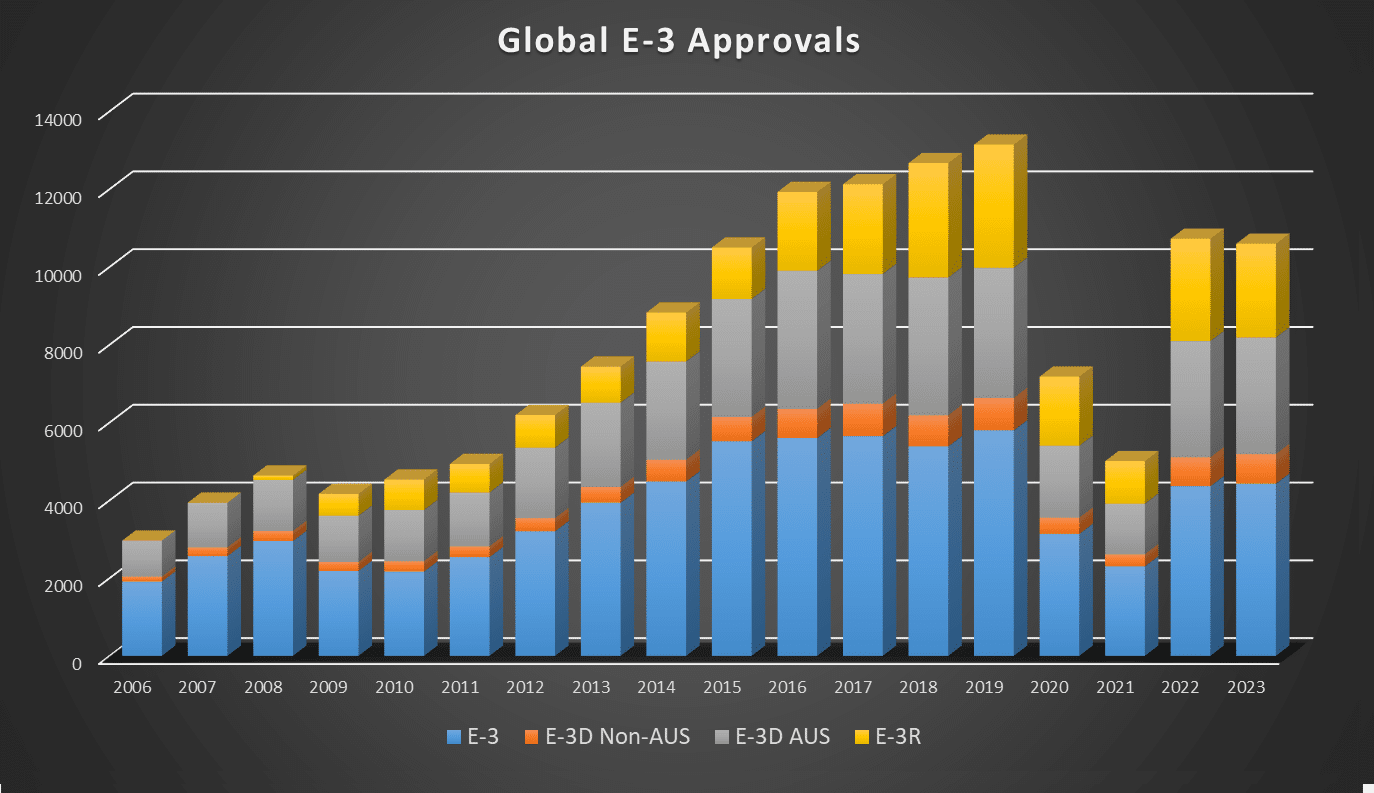

E-3 Visas issued to Australians living in America

The E-3 visa category rebounded in 2022 with 4,371 E-3s, 3,729 E-3Ds, and 2,631 E-3 Rs. This represented approximately 30% of the total non-immigrant visas issued to Australians that year.

However, 2023 saw a slight decrease in E3 visas to 4,334. E3D visas slightly increased to 3,759, and E3D visas decreased to 2,410.

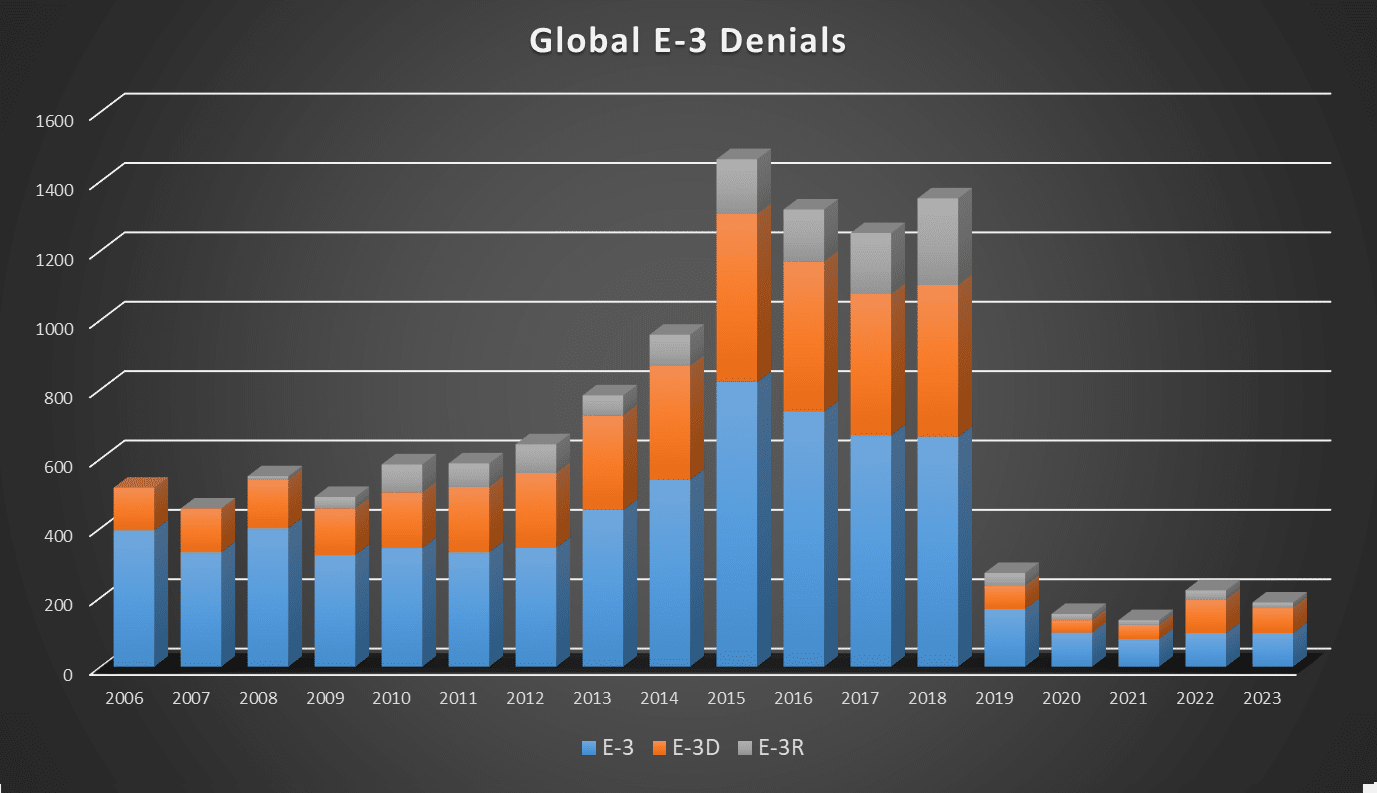

E-3 Visa Denials

The percentage of E-3 visas denied in 2022 rose sharply over 2021. However, they fell in 2023. There were 221 denials in 2022 and 186 in 2023.

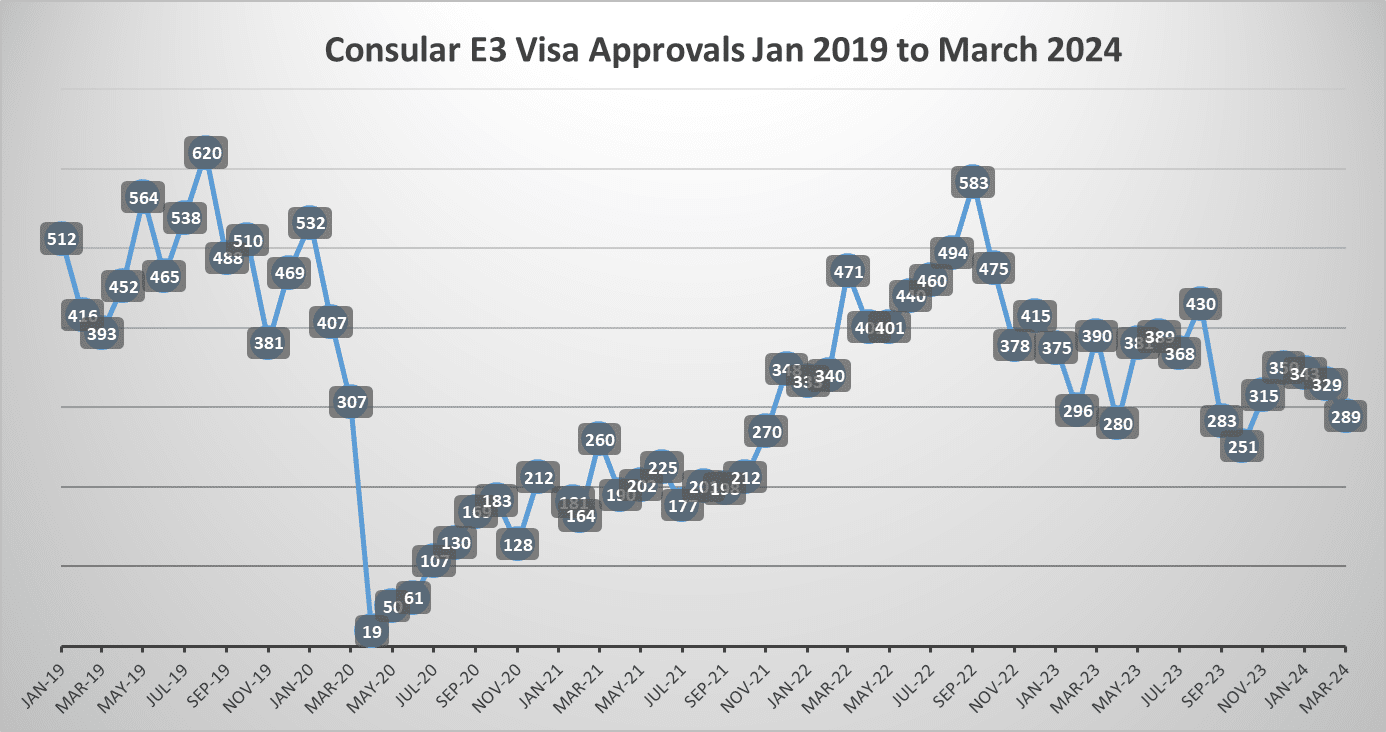

Is the E-3 Visa Returning to the Mean?

Before the Pandemic, the monthly E-3 visa approvals floor was around 400 visas, with peaks above 500. In 2022 they appeared to return to the mean with that same floor of 400 and a peak of 583 in September 2022.

However, it appeared that 2022’s numbers were driven by clearing the backlog of appointments.

In 2023, we witnessed the floor drop to around 300, with the peak at only 430.

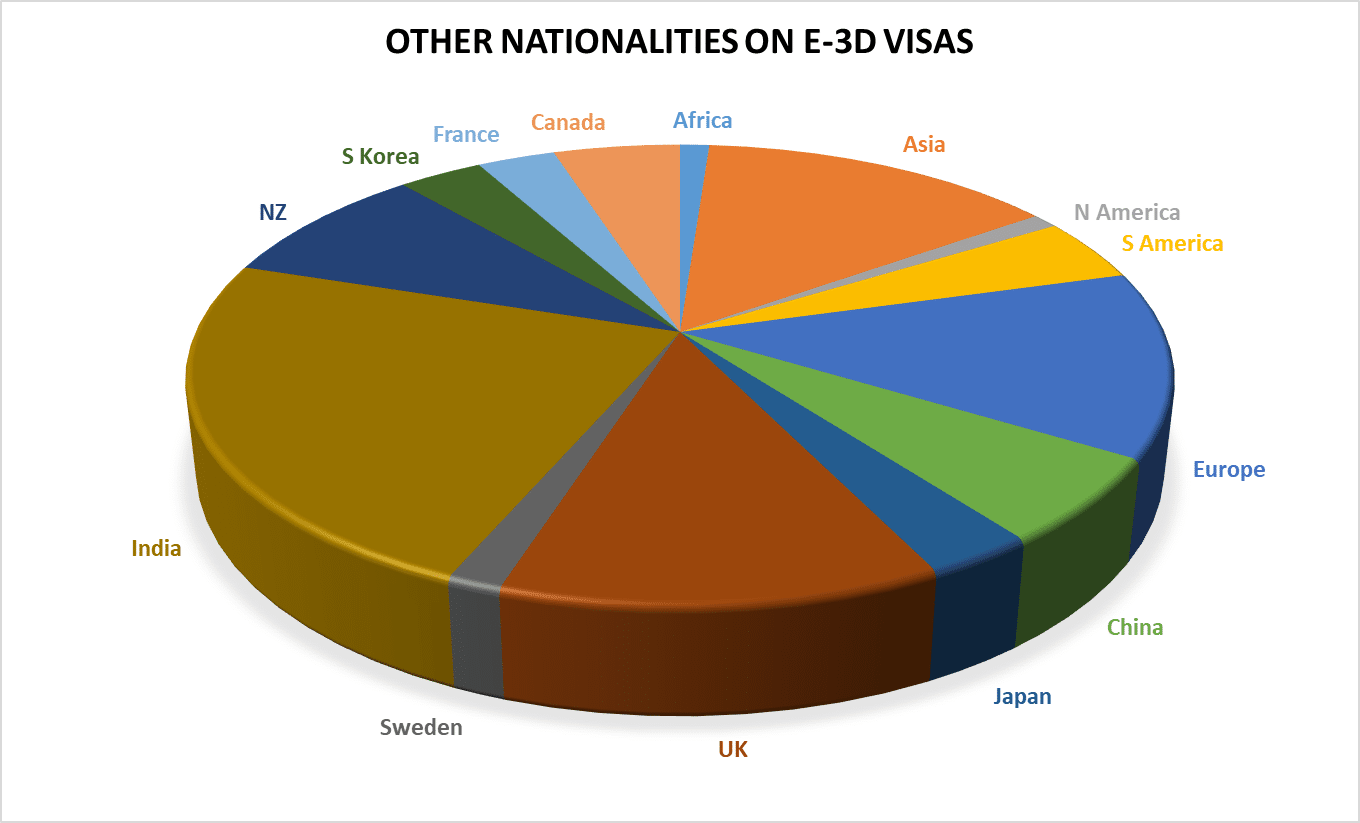

Other Nations on the E-3D Visa.

Another remarkable chart is the spouses and children on an E-3D who are not Australian citizens. In 2022, there were 2,622 Australians and 667 Nationals from countries on an E-3D visa. In 2023 that number rose to 762.

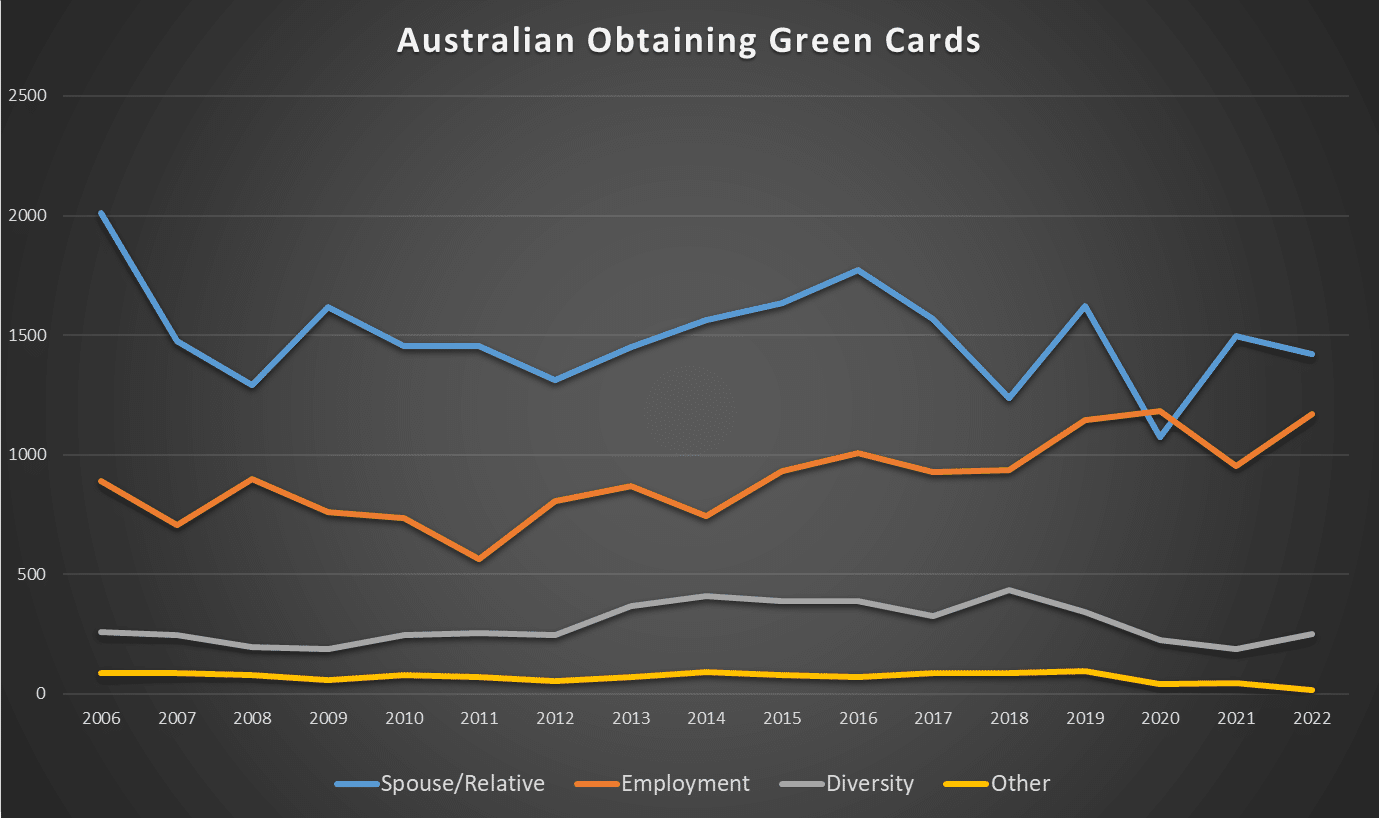

Let’s not forget Green Cards

Unlike non-immigrant visas, Australians on Green Cards have been relatively flat over the past decade. However, the number of Australians on employee-sponsored Green Cards has steadily increased.

Given that 46,831 Australians have received Green Cards since 2006, it would not be out of the realm of possibility that more than 30,000 Australians are currently in America either on a Green Card or have taken citizenship – factoring in repatriation.

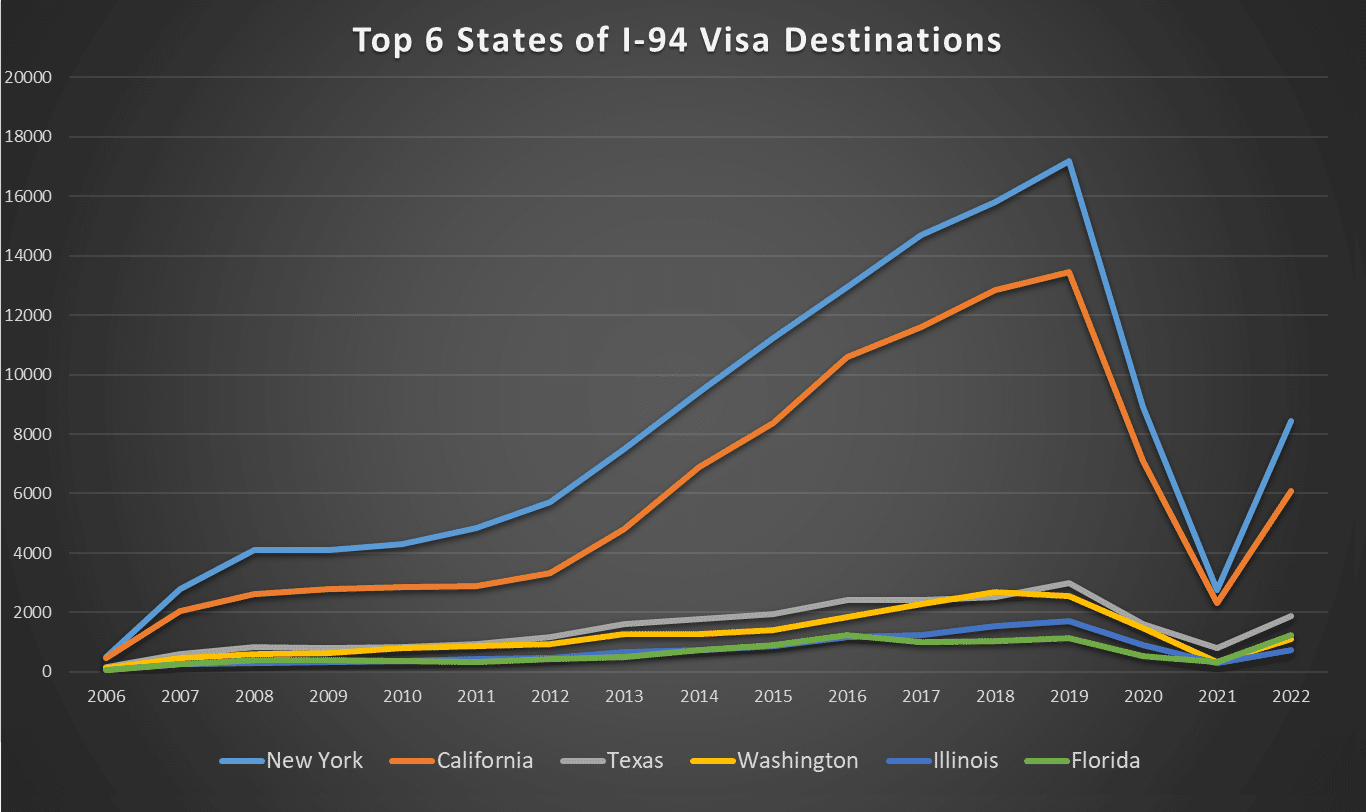

Where are Australians on an E-3 Living in America?

New York has consistently led California as the preferred destination for Australians. This source of data is derived from the destinations recorded by Australians on their I-94 form.

So, How many Australians live in the U.S.?

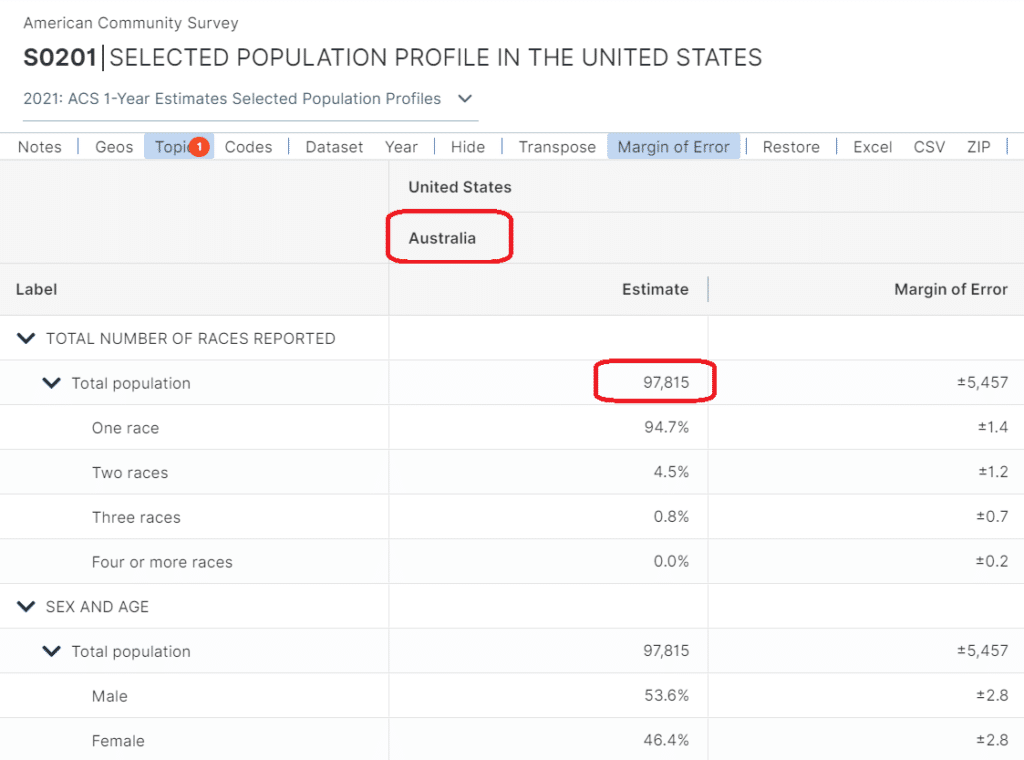

According to the U.S. Census Bureau, in 2021, there were 97,815 Australians in America.

Our data is that at the end of 2023, there were c.70,000 Australians on non-immigrant visas and c.30,000 Permanent Residents and Dual Citizens, i.e. 100,000.

Based on the I-94 data, around 30% of Australians live in New York, and around 25% live in California.

Open US Bank and Credit Card Accounts from Australia and have instant access when you land!

Step 1: Open a US bank account before you leave Australia

The Australian Community offers a convenient and efficient way to open US bank and credit card accounts from Australia, even before you get a Social Security Number.

Step 2: Fund your newly opened US account with a Preferred Rate on AUD to USD negotiated for our Members with OFX.

Register and see why our Preferred Rate beats Australian Banks and major online FOREX services to stretch your AU Dollar further!

Join The Australian Community.

Founded in 2011, we connect more Australians in America.

If you are a professional Australian taking your career to the next level, or the U.S. is the next step in your company's global expansion, we can connect you to all of the resources you need for success in America.

Learn more about the benefits of joining The Australian Community in America.

Did you find this article helpful? Would you like to make a Donation!

The Australian Community is a 501(c)(3) organization, and all donations are fully tax-deductible under the IRS Code.