Thank You for Registering

Thank you for registering for The Australian Community’s 2021 Creative Challenge Short Film Competition.

We have received your registration, so now you can begin working on your short film that will be judged by popular vote on how well it embodies three elements: Australia, Community and features an American city.

If you have never made a short film, consider these points:

- Start with a Story Board – this will help you plan out your short film.

- Your Story Board will then guide you through the creation/editing of your script.

- Think of your camera angles – they may only be subtle changes, but knowing when to use close up or side angles can really make a difference to your short film.

- Plan your lighting. Without the right lighting scenes can look washed out or too dark. If you are filming during the day, avoid harsh light and shadows – unless you are using them for effect.

- Have good sound. If your audience cannot hear the dialog, you will lose them in a New York minute. You may be able to get away with low quality video, but you cannot get away with low quality sound.

Looking for Inspiration?

Then, check out the Australian Short Film Today website and access great content and insight into Australian short films.

Don’t Forget…

- Entries close at 5:00 PM on October 15th so be sure to send us the link to your short film before the deadline!

- Entries must be emailed to [email protected]

- By submitting a registration, you have agreed to the Terms and Conditions of the competition.

NEWS AND KNOWLEDGE

The Carousel Moment. Every Australian Ex-Pat in the US will experience two carousel moments. The first is when you arrive and are standing at an…

The Australian Community is committing up to $50,000.00 to support Australian Culture in 2024! Throughout the year, there are dozens of events in New York…

Connect with our “Mates Rates” on Foreign Exchange! Do you want to save every time you transfer money internationally? There is a lot of noise…

As an Australian Ex-pat living in the U.S., filing your property tax returns, or even applying for a mortgage in Australia can be a daunting…

australian community in america

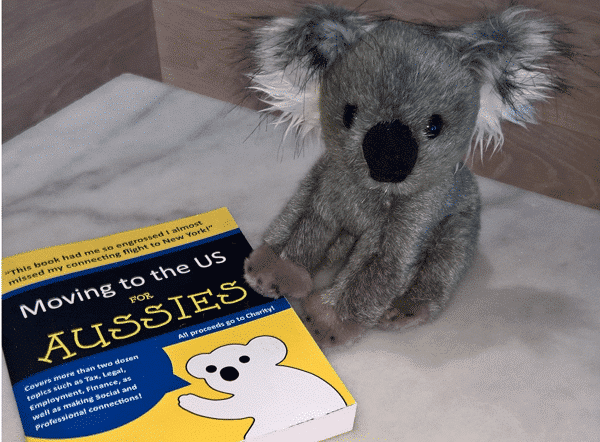

Moving to America from Australia is a huge decision for Aussies. Our book Moving to the US for Aussies is the culmination of years of…

About The Australian Community

Based in New York City and now in our tenth year, our 501(c)(3) organization was formed specifically to connect professional Australians in America. Over the past decade, The Australian Community has assisted tens of thousands of Australians in New York and across America.

In addition to our public social media, our members connect through a private Enterprise Social Network. Our network facilitates 1:1 connections. Most importantly, it contains the largest private Australian knowledge base in North America.

Therefore, whether you are an Australian in New York or another U.S. city, our non-profit services can connect you with other professional Australians to help you achieve your business goals.

If you are an Australian living in or moving to America, you can join The Australian Community.

Make a Tax-Deductible Donation

Our organization relies on the generosity of its members and supporters to continue our good work, assisting Australians living in the United States.

Please consider making a tax-deductible donation to our 501(c)(3) public charity.

All contributions are fully tax-deductible under Section 170 of the IRS Code. In addition, the Australian Community is qualified to receive tax-deductible bequests, devises, transfers, or gifts under sections 2055, 2106, or 2522 of the Code.